🚀 Introduction: Why Pitch Decks Still Make or Break VC Funding in 2025

In the age of AI copilots, ChatGPT pitch bots, and investor data rooms, one thing hasn’t changed—your pitch deck is still the single most powerful tool to raise venture capital.

Whether you’re an early-stage founder in India or the Middle East, the first impression your deck makes often determines whether a VC will take a meeting or skip you entirely. In this teardown guide, we’ll analyze what great pitch decks have in common, what investors hate, and what slides are absolutely essential in 2025.

✅ What a Winning Pitch Deck Looks Like in 2025

Top-tier pitch decks are not about fancy design—they’re about clarity, insight, and storytelling.

Here’s the standard pitch deck structure used by successful founders across Dubai, Riyadh, Bengaluru, and beyond:

1. Title Slide

Include your logo, one-line elevator pitch, and contact info.

Example: “ZettaPay — AI-Powered Payments for GCC’s Freelancers”

Tip: Add a short descriptor of your business model and traction—this builds instant context.

2. Problem Slide

Frame the pain point clearly. Use real-world stats or anecdotes.

Bad: “People don’t have good payment tools.”

Good: “92% of freelancers in UAE still get paid via manual bank transfers.”

3. Solution Slide

Introduce your product. Keep it visual.

Do: Show a product screenshot or quick workflow.

Don’t: Describe your tech stack here—it’s too early.

4. Market Opportunity

Show your TAM–SAM–SOM. Investors want a large and growing market.

Bonus: Localize it—“$1.3B annual spend on blue-collar payroll solutions in MENA”

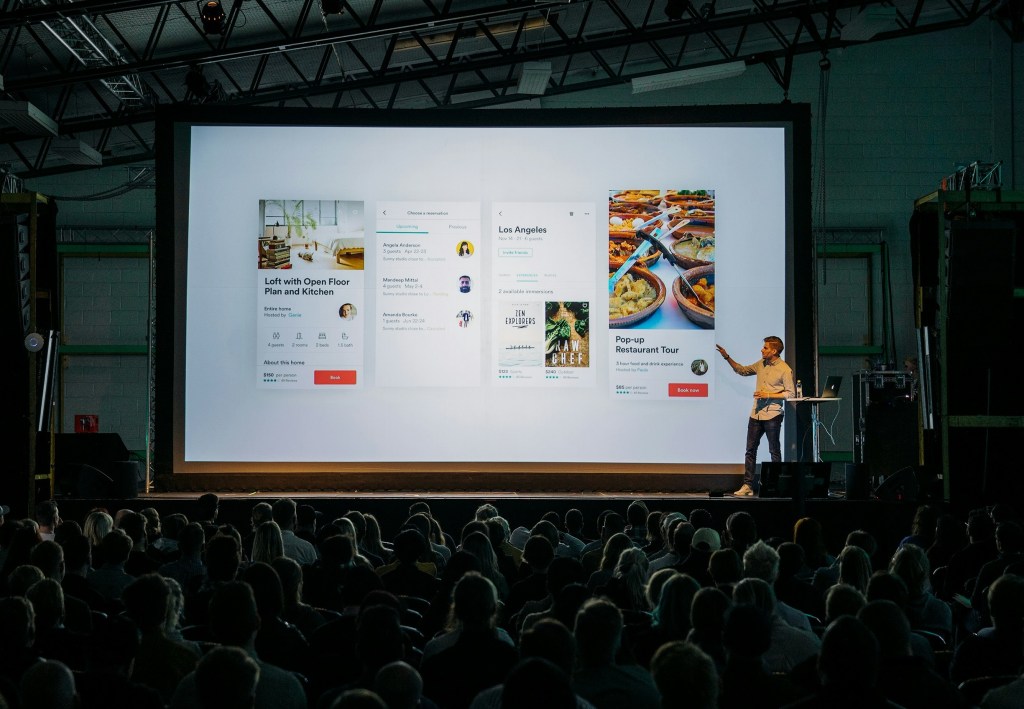

5. Product Demo / Screens

Screenshots > words. Show the product UI.

If you’re hardware/biotech: Include diagrams, prototypes, or a 30-sec video link.

6. Business Model

Be clear: Who pays, how often, and how much?

Great example: “$9.99/month per active user. 30% margin. 80% annual retention.”

7. Traction Slide

Show growth with metrics:

- Revenue, Users, GMV, CAC, MRR

Use a simple chart with 3–6 month trend.

If pre-revenue: Show pilots, waitlists, partnerships, testimonials.

8. Go-to-Market Strategy

Explain how you’ll acquire customers.

Great format:

- Target persona

- Channels (paid, inbound, BD)

- Sales cycle & unit economics

9. Competition Slide

Use a matrix or quadrant to show where you win.

Avoid generic “we have no competitors” or cluttered logos.

10. Team Slide

Highlight founder-market fit. Show faces, logos of prior companies, and short bios.

VCs back people. If your team built a unicorn or led growth at a major MENA firm, highlight it.

11. Financials (if applicable)

Include 3-year projections, burn rate, and cash runway.

Bonus: Add assumptions (“we grow paid users by 15% MoM”)

12. Fundraise Ask

Show how much you’re raising and how it’ll be used.

Example:

“We’re raising $1.5M seed to hit $50K MRR over 18 months. Use: 60% team, 25% GTM, 15% infra.”

🧠 What Doesn’t Work: Common Pitch Deck Mistakes

Even great startups lose investor interest because of avoidable deck mistakes:

❌ 1. Too much text per slide

Keep it visual. One idea per slide. No essays.

❌ 2. No traction or proof of concept

Even pre-product startups should include waitlists, pilots, or early engagement metrics.

❌ 3. Confusing business model

If your revenue stream is unclear or “TBD,” VCs won’t trust you’ve done your homework.

❌ 4. Generic problem statement

“X is broken” doesn’t tell me who it hurts, how much, or why now.

❌ 5. No differentiation

You need a clear edge—either in product, timing, or insight. “We’re like Uber for laundry” won’t cut it anymore.

❌ 6. Missing contact info

Always include your contact and Calendly link. Don’t make the VC hunt for it.

🔍 Real-World Examples of Great Pitch Decks (2025 Trends)

🧪 Case Study 1: Climate Tech SaaS in UAE

Raised $2.2M Pre-Seed with 9-slide deck. Key winning elements:

- Focused on new ESG compliance laws in UAE

- Visual demo of dashboard

- Strong co-founder credentials (ex-Mubadala, Palantir)

🛍️ Case Study 2: D2C Brand in India

Raised $1M seed with 12-slide deck. What worked:

- 3-month GMV growth

- Sharp founder story

- GTM plan with influencer + regional distributor channels

🔧 Tools to Build a Great Pitch Deck

- Beautiful.ai – Templates for pitch-ready decks

- Pitch.com – Clean, collaborative design

- Canva for Startups – Prebuilt VC templates

- Founder’s Guide (Downloadable) – [Coming soon on FounderFirst.org]

💼 Who Should See Your Pitch Deck?

Great pitch decks deserve warm intros. Target:

- MENA-focused VCs (see: our article on “Top 10 Middle East VCs in 2025”)

- Sector-aligned investors (fintech, SaaS, D2C, etc.)

- Angels with relevant operator backgrounds

Use platforms like:

- LinkedIn + Twitter (X): Follow + engage before you pitch

- AngelList / SeedBlink / Hub71

- Founder communities: Flat6Labs, Sequoia Spark, 500 MENA, T-Hub, VentureSouq Labs

📝 TL;DR: Perfect Pitch Deck Formula for 2025

Here’s your VC-ready deck checklist:

- Problem

- Solution

- Market Size

- Product Screens

- Business Model

- Traction

- Go-to-Market

- Competition

- Team

- Ask & Use of Funds

- Bonus: Financials (if applicable)

🧭 Final Advice: Sell the Vision, Not Just the Product

VCs fund companies that can become category leaders, not just good businesses.

So, your pitch deck should communicate:

✅ A clear mission

✅ Why now is the right time

✅ Why you’re the right team

✅ How big this can get

Subscribe to FounderFirst.org to download free pitch deck templates, checklists, and get your deck reviewed by VCs.

📥 Want a teardown of your own pitch deck? Drop us your deck & we might feature it in our next article.

Leave a comment