Coverage: how to get VC funding India, attract venture capital GCC, VCs in India 2025, pitch to Middle East investors, early-stage fundraising tips, seed funding India GCC, how to reach VCs

📈 Introduction: The Race to Raise Capital Has Never Been More Competitive

As of 2025, India and the GCC (Gulf Cooperation Council) are home to two of the most dynamic venture capital ecosystems in the world. India boasts a booming digital economy with over 100 unicorns, while the GCC is investing billions into tech, AI, fintech, and climate solutions as part of their long-term economic diversification.

But with more founders launching startups than ever before, one question keeps coming up:

“How do I stand out and get noticed by top-tier VCs in India or the Middle East?”

This article offers a step-by-step framework with actionable insights to help you attract attention from investors like Blume Ventures, Peak XV (Sequoia India), Elevation Capital, Shorooq Partners, BECO Capital, and other active funds across the region.

🎯 Step 1: Know Your VC Audience

Before you even think about pitching, study your target VCs like they’re your customers.

✅ What You Should Know:

- Stage focus: Do they invest in pre-seed, seed, or Series A?

- Sector thesis: Do they focus on SaaS, fintech, D2C, deeptech, climate?

- Geographic sweet spot: Some VCs back only Indian startups; others specialize in GCC or cross-border models.

- Recent investments: Helps you personalize your approach and validate interest.

Example: If you’re a D2C beauty brand, Fireside Ventures (India) is a better fit than a B2B SaaS specialist like Matrix Partners India.

🧠 Step 2: Build a Strong Narrative and Mission-Driven Story

Investors fund founders, not just businesses. In both India and GCC, storytelling is a secret superpower.

🔥 What Your Story Should Communicate:

- Why you are the right person to solve this problem

- How you discovered the problem (personal insight > generic research)

- Why now is the perfect time to build this company

- What your long-term vision looks like

VCs in the Middle East, in particular, are drawn to founders who are globally ambitious but regionally rooted.

📊 Step 3: Show Early Traction or Signal Demand

Whether you’re pre-revenue or post-product, you need some form of validation.

For Pre-Revenue Startups:

- MVP with early user feedback

- Waitlist signups

- Partnerships or LOIs

- Paid pilots or beta users

For Early-Stage Startups:

- Revenue growth (MRR, GMV, etc.)

- Customer retention data

- CAC vs LTV insights

💡 Pro Tip: Indian VCs love product-led growth; GCC VCs lean into enterprise deals and regional partnerships.

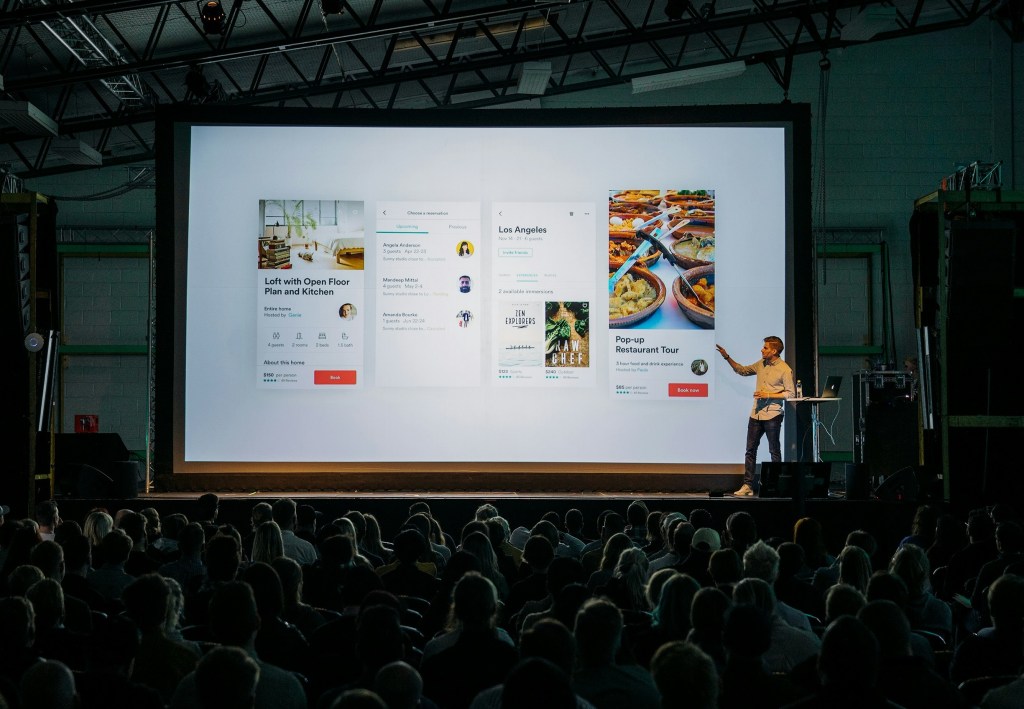

📁 Step 4: Craft a High-Quality Pitch Deck

This is your calling card.

Your Deck Should Include:

- Problem

- Solution

- Market size (TAM/SAM/SOM)

- Product demo/screens

- Business model

- Traction

- GTM strategy

- Competition

- Team

- Fundraise ask

Design it cleanly, keep text minimal, and don’t exceed 12–15 slides. Tailor slightly for GCC vs Indian investors—local context matters.

📬 Step 5: Reach Out Strategically

The best way to get noticed is through warm introductions. But cold outreach can work—if done right.

🔑 Best Outreach Channels:

- LinkedIn (follow VCs, engage on their posts, then DM)

- Founder or portfolio referrals

- Twitter/X

- Demo days (Techstars Riyadh, Flat6Labs, Sequoia Spark, Nasscom 10,000 Startups)

- Cold email (with crisp pitch and data)

📧 Sample Cold Email Template That Gets Replies:

Subject: India-GCC Fintech – $18K MRR in 4 Months – Raising Seed Round

Hi [Investor Name],

I’m [Your Name], co-founder of [Startup Name], a cross-border fintech platform connecting freelancers in India with clients in GCC.

We’re seeing $18K MRR with 3,000+ users onboarded organically.

Raising $750K seed round to scale GTM across UAE & KSA.

Sharing a short deck here: [Link]

Would love to hear your thoughts.

Thanks,

[Your Name] | [LinkedIn] | [Calendly]

🤝 Step 6: Attend the Right Investor-Focused Events

VCs often discover founders offline before they invest online.

🔍 High-Impact Events:

- India: TechSparks, SaaSBoomi, Surge, YourStory Demo Day

- GCC: Gitex Future Stars, RiseUp Riyadh, Fintech Abu Dhabi, Expand North Star

- Pan-Regional: Step Conference, Web Summit Qatar, Leap Riyadh

Make it a point to speak, pitch, or network at these events and follow up quickly.

🧲 Step 7: Build a Strong Online Presence

Top investors check your digital footprint before replying.

Minimum Online Hygiene:

- Optimized LinkedIn profile with traction or product updates

- Website with clear value proposition and product screenshots

- Blog, podcast, or guest features (especially effective in GCC)

- Twitter/X for thought leadership (especially for Indian SaaS founders)

💬 Bonus: Things VCs Notice (But Founders Often Ignore)

- Responsiveness: Reply fast. VCs notice momentum.

- Data cleanliness: CAC, runway, cap table—know your numbers.

- Founder chemistry: Passion, humility, and clarity win.

- Follow-up decks: If rejected, update them on progress. It works.

❌ Mistakes That Stop VCs from Responding

- ❌ Generic outreach with no traction

- ❌ Pitch decks filled with jargon and no user insight

- ❌ No clear ask (“raising funds” isn’t enough)

- ❌ Confusing or incomplete business model

- ❌ Long cold emails with no value hook

🔍 Top VCs in India & GCC That Back Early-Stage Startups

Here’s a quick list of top firms you can research:

India

- Blume Ventures

- Peak XV (Sequoia India)

- Elevation Capital

- India Quotient

- 3one4 Capital

- Stellaris Venture Partners

- Venture Highway

GCC

- Shorooq Partners

- BECO Capital

- Raed Ventures

- Wamda Capital

- Outliers VC

- Flat6Labs

- VentureSouq

- Nama Ventures

- Khwarizmi Ventures

(See our dedicated article: “Top 10 VCs in India and GCC in 2025” for full profiles.)

🎯 Final Advice: VCs Invest in Signals, Not Just Ideas

To get noticed in a crowded market:

- Nail your story + traction

- Craft a VC-specific pitch

- Build credibility in your space

- Be proactive and follow up

- Stay resilient—VCs often pass, then return

🔥 Want to download a VC outreach checklist or get your pitch reviewed?

Subscribe to the FounderFirst.org Newsletter — actionable tips, investor profiles & teardown sessions weekly.

Leave a comment