Coverage: mistakes while raising funding, first-time founder funding errors, seed round mistakes India, early-stage fundraising pitfalls, how to raise VC money, startup funding tips 2025, GCC founders, India startup fundraising guide

📈 Introduction: Fundraising Is a Skill, Not a One-Time Event

Raising your first round of venture capital — whether it’s pre-seed, seed, or angel investment — is one of the most defining moments of your startup journey. It’s exciting, but it’s also full of traps that many first-time founders unknowingly fall into.

Whether you’re a founder in India, the UAE, Saudi Arabia, or any part of the Middle East, the stakes are high. Investors are sharp. The capital is competitive. And your ability to raise funding without mistakes can be the difference between a fast-growing startup and a failed venture.

In this guide, we break down the top 10 fundraising mistakes founders make during their first round — and how to avoid them in 2025.

❌ Mistake #1: Pitching Before You’re Ready

Too many founders start pitching before they have clarity on the problem, solution, or traction.

🔍 What’s Missing:

- A clearly defined problem

- A compelling founder story

- MVP or early user signals

- Target customer and GTM insights

✅ What to Do Instead:

- Build a strong narrative

- Validate demand through early pilots or user interviews

- Tighten your pitch deck before reaching out to VCs

❌ Mistake #2: Not Researching the Right VCs

Not all VCs are the same. Sending cold emails to every investor you find on LinkedIn rarely works.

🔎 Common Errors:

- Pitching late-stage funds for pre-seed rounds

- Approaching sector-agnostic funds when you’re deeptech or biotech

- Ignoring geographic relevance (GCC vs India focus)

✅ Fix It:

- Create a targeted investor list by stage, geography, and sector

- Use platforms like Crunchbase, Tracxn, or Pitchbook

- Prioritize warm intros through portfolio founders or angels

❌ Mistake #3: Weak or Confusing Pitch Deck

Your pitch deck is your startup’s first impression. If it’s unclear, crowded, or generic — VCs won’t even read past slide 2.

🚫 Avoid:

- 30-slide decks

- Vague statements like “we’re the Uber for X”

- Missing traction, business model, or ask

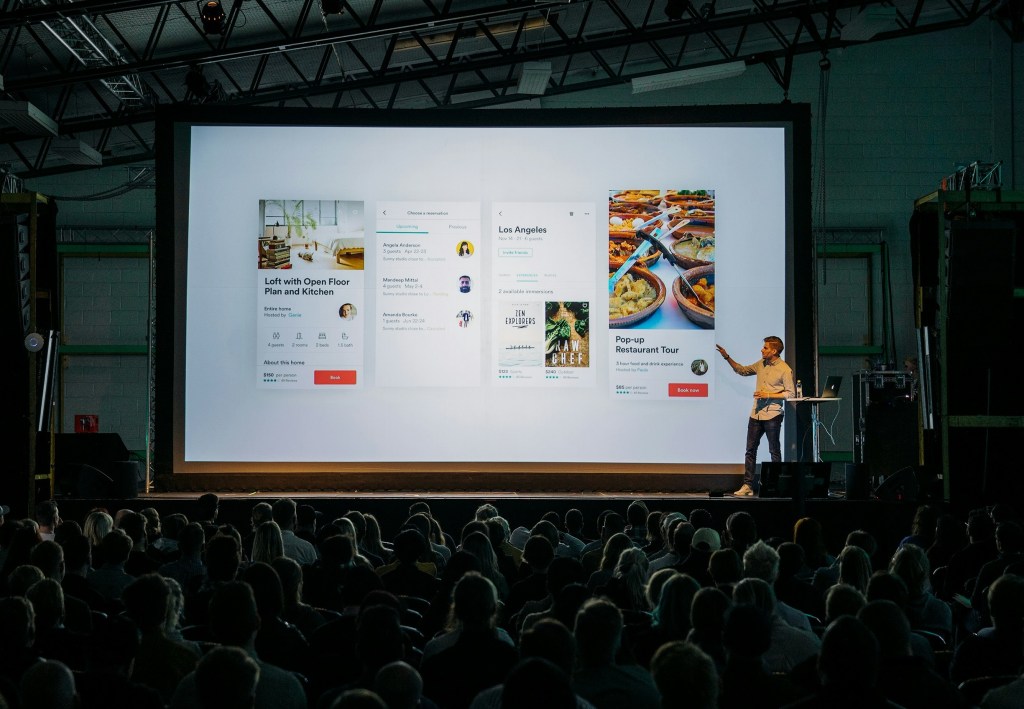

✅ Include These Must-Have Slides:

- Problem

- Solution

- Market Size

- Product Screens

- Business Model

- Traction

- Go-to-Market

- Team

- Ask & Use of Funds

💡 Tip: Customize slightly for Indian vs GCC investors — market context matters.

❌ Mistake #4: Over-Optimizing for Valuation

Chasing the highest valuation at the seed stage can backfire. It can scare away smart capital and create a down round risk later.

Why It Happens:

- Overconfidence

- Unfounded market comps

- FOMO-driven founders

✅ Better Approach:

- Focus on bringing strategic investors

- Raise what you need, not what looks good

- Leave room for future round growth

❌ Mistake #5: Ignoring the Cap Table

Many founders give away too much equity early to friends, advisors, or service providers.

👎 Common Signs of a Messy Cap Table:

- Co-founders split equity 50/50 without roles

- Advisors holding >5% without milestones

- No ESOP plan for future hires

✅ Fix It:

- Use standard equity models (70% founders, 15% ESOP, 15% investors)

- Vest all founder and advisor equity

- Clean up before approaching VCs

❌ Mistake #6: Talking to Investors Without a Clear Ask

Saying “we’re looking to raise funds” without specifying how much or why kills momentum.

✅ Always Include:

- Amount raising (e.g., $500K pre-seed)

- Valuation expectation (or SAFE terms)

- Use of funds (e.g., 60% team, 25% GTM, 15% infra)

Bonus Tip:

Have a one-pager and a 15-minute pitch deck version ready for intro calls.

❌ Mistake #7: Poor Storytelling and Communication

Even with a great product, if you can’t communicate it simply, VCs will pass.

Common Issues:

- Using jargon

- No emotional hook

- Data-heavy slides with no story arc

✅ How to Fix:

- Lead with the “why now”

- Use analogies (“we’re like Shopify for GCC services”)

- Practice your pitch with non-tech friends and iterate

❌ Mistake #8: Not Building Investor Relationships Early

Founders often start fundraising when they need money — but the best raise from relationships built 6 months earlier.

✅ What You Should Do:

- Send monthly investor updates (even before raising)

- Engage on LinkedIn & Twitter

- Ask for feedback, not just funding

💬 “When you ask for money, you get advice. When you ask for advice, you often get money.”

❌ Mistake #9: Failing to Show Traction (or Substitute Signals)

Even pre-revenue, you need some signal of momentum.

Good Traction Signals:

- Waitlist signups

- Early pilots with partners in India or UAE

- Product usage or retention

- Creator/influencer shoutouts (for D2C/B2C)

No Traction? Use:

- Market insight + timing

- Strong founder-market fit

- Competitive edge (tech IP, regulatory moat)

❌ Mistake #10: Taking the First Term Sheet Too Fast

Founders often take the first offer they get out of excitement or fear.

🛑 Danger Signs:

- No founder-friendly terms

- High liquidation preferences

- Excessive control or veto rights

- No real value beyond money

✅ Instead:

- Talk to 10–20 investors

- Compare terms, not just capital

- Choose long-term partners over fast cash

🧭 Final Advice: Fundraising Is a Process, Not a One-Off Event

Raising your first round isn’t just about money — it’s about choosing who helps you build, scale, and survive.

Here’s what separates successful fundraising founders from the rest:

- They plan 6–12 months in advance

- They build investor relationships before asking

- They tell a compelling story backed by data

- They surround themselves with mentors who’ve raised before

🧠 Quick Summary: Top 10 Mistakes Founders Make While Raising Capital

- Pitching before you’re ready

- Not researching target investors

- Weak or confusing pitch deck

- Over-fixating on high valuation

- Messy or unbalanced cap table

- No clear fundraising ask or use of funds

- Poor storytelling and pitch delivery

- Starting relationships too late

- No traction or substitute signal

- Accepting the first term sheet blindly

📥 Want to Avoid These Mistakes?

→ Subscribe to FounderFirst.org to download your free Founder Fundraising Checklist — plus investor email templates, pitch deck samples, and cap table calculators.

Leave a comment