Coverage: early-stage VC India, first-time founder funding India, seed investors India 2025, top VCs India, startup investors, Series A VCs India, Indian VC firms for new founders, venture capital India startups, VC list India

🚀 Introduction: Finding the Right VC as a First-Time Founder in India

India’s startup ecosystem has matured rapidly in the past decade, with thousands of startups being launched each year. Yet, for first-time founders, one of the toughest hurdles remains raising early-stage venture capital — especially from VCs willing to bet on new, unproven entrepreneurs.

If you’re building your first company in India, whether in SaaS, fintech, consumer tech, AI, or climate, you need VCs who not only write checks but also provide hands-on support, network access, and credibility in your industry.

This article lists the top early-stage VC firms in India in 2025 that have consistently backed first-time founders from idea to product-market fit — many before revenue, traction, or even a live product.

🎯 What to Look for in an Early-Stage VC for First-Time Founders

Not all VCs are the same. As a first-time founder, prioritize those who:

- Invest pre-revenue or at MVP stage

- Have experience mentoring young or solo founders

- Provide operational support (hiring, GTM, product)

- Have a strong founder community/network

- Don’t over-index on pedigree (IIT/IIM/FAANG-only bias)

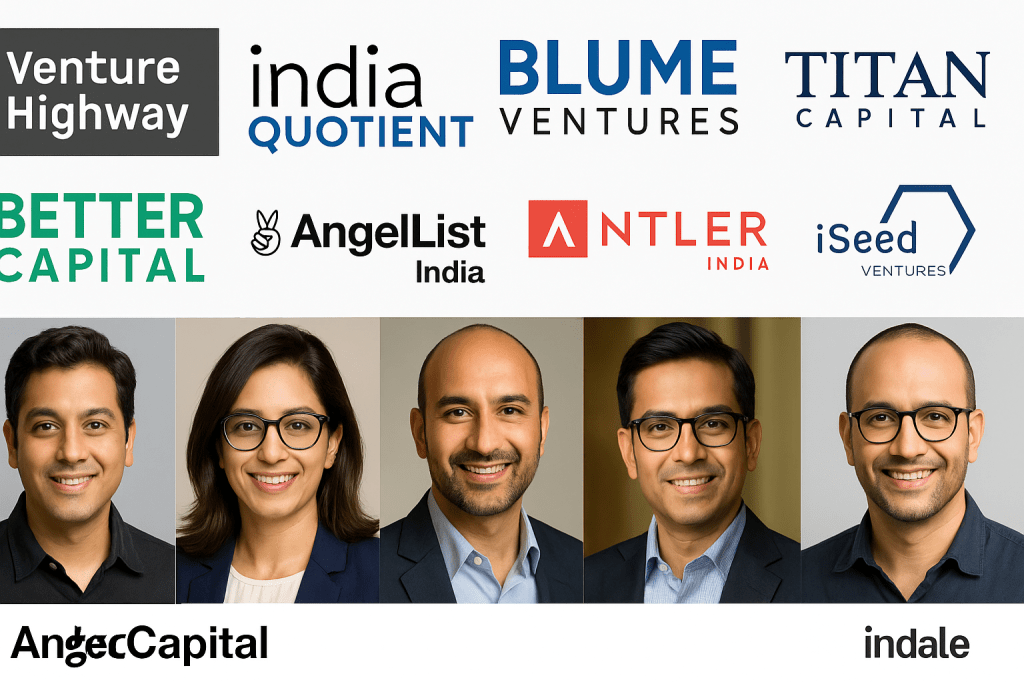

🏆 Top Early-Stage VCs in India Backing First-Time Founders

Here’s a curated list of VC firms that have led or participated in pre-seed to Series A rounds of first-time Indian entrepreneurs in recent years.

1. India Quotient

- Stage: Pre-seed to Series A

- Check Size: ₹1–10 Cr

- Sector Focus: Consumer tech, D2C, SaaS, social apps

- Notable Investments: ShareChat, PagarBook, Lokal

- USP: One of the earliest believers in non-metro founders, supports quirky and bold ideas

✅ Known for writing first cheques and backing unconventional ideas

2. Venture Highway

- Stage: Pre-seed, Seed

- Check Size: ₹2–7 Cr

- Focus: SaaS, Fintech, AI, B2B, Deep Tech

- Investments: Moglix, BharatAgri, OkCredit

- USP: Focused on product-first startups with solid tech DNA

3. Blume Ventures

- Stage: Pre-seed to Pre-Series A

- Check Size: ₹2–15 Cr

- Investments: Unacademy, Dunzo, Smallcase, Classplus

- USP: Offers Blume Founders Fund and high-touch support with fundraising, hiring, GTM

✅ Very friendly to first-time founders with sharp execution

4. First Cheque

- Stage: Pre-seed

- Check Size: ₹25L – ₹1 Cr

- Focus: Idea-stage, often before incorporation

- USP: As the name suggests, they’re often the first cheque in. Great for first-time solo founders.

5. Titan Capital (by Snapdeal Founders)

- Stage: Pre-seed to Seed

- Check Size: ₹20L – ₹3 Cr

- Investments: Ola, Mamaearth, UrbanClap, Razorpay

- USP: Quick decisions, minimal red tape, founder-focused approach

6. Better Capital

- Stage: Pre-seed to Seed

- Check Size: ₹20L – ₹3 Cr

- Investments: Teachmint, Rupifi, Khatabook

- USP: Fastest decision-making in the ecosystem. Transparent founder–VC alignment.

✅ Great fit for new founders who need early conviction and trust

7. AngelList India (Syndicates)

- Stage: Pre-seed

- Check Size: ₹20L – ₹2 Cr via syndicates

- USP: Great way to get access to 20–50 micro angels or founders in one round

- Popular Syndicate Leads: Utsav Somani, Ashish Dave, Anand Chandrasekaran

8. Antler India

- Stage: Pre-idea to Seed

- Check Size: ₹60L – ₹3 Cr

- Program: Antler Residency for solo founders

- USP: Helps founders find co-founders, refine ideas, and raise capital within 12 weeks

9. 100X.VC

- Stage: Pre-seed (via iSAFE notes)

- Check Size: ₹25L – ₹1 Cr

- USP: Structured cohort-based investment model, ideal for fresh founders with sharp pitches

- Bonus: Helps startups raise follow-on from institutional VCs

10. iSeed Ventures

- Stage: Pre-seed

- Focus: New founders, India-first businesses

- USP: Run by AngelList’s former India head, super friendly to founders without pedigree

🔍 What Makes These VCs Stand Out for First-Time Founders?

| VC Firm | Speed | Support | Ideal for Solo Founders | Participates in Follow-ons |

|---|---|---|---|---|

| Blume Ventures | Medium | High | Yes | Yes |

| India Quotient | Fast | Medium | Yes | Yes |

| Better Capital | Very fast | Medium | Yes | Occasionally |

| First Cheque | Fast | Medium | Yes | Sometimes |

| 100X.VC | Fast | High (cohort) | Yes | Yes |

📊 How to Prepare to Pitch These VCs

Even if you’re a first-time founder, you need to come prepared. Here’s what they expect:

✅ Pre-seed/Seed Stage VC Checklist:

- Crisp pitch deck (problem, solution, team, market, GTM, traction, vision)

- Demo/MVP (if available)

- Cap table (even if simple)

- Founder background and narrative

- Market research (especially TAM and insights)

🔗 Download our free pitch deck template for early-stage Indian founders at FounderFirst.org/library

💬 Advice from First-Time Funded Founders

“First Cheque took a bet on me when I just had an idea and a Notion doc. That belief was everything.”

— Arjun, founder of an edtech startup

“Better Capital closed in 7 days. No unnecessary meetings — just high-conviction writing.”

— Priya, B2B SaaS founder

🔗 Bonus: Where to Discover & Apply to Early-Stage VCs

- AngelList India: Build your profile and apply to syndicates

- Apply via VC websites: Most now have application portals

- Events & accelerators: TLP, Surge, Antler, 100X cohorts

- Founder communities: Founders vs Covid, Blume Tribe, Twitter/X

📌 Final Thoughts: The VC-First Time Founder Fit Matters

Your first VC is not just capital — they’re a partner in your journey. Choose someone who:

- Understands your stage

- Believes in you, not just traction

- Has time to support

- Will back you again in the next round

India now has more early-stage capital than ever, and more founders from Tier 2/3 cities are being funded. Your pedigree matters less than your persistence, clarity, and execution.

📥 Subscribe to FounderFirst.org for:

- Curated investor lists

- Outreach templates

- Pitch teardown series

- First-time founder resources

Leave a comment