Coverage: raise startup funding UAE, Saudi VC firms, Egypt startup investment, MENA venture capital, how to raise funding in Middle East

🧭 Why Founders Should Look to the Middle East for Startup Capital

The startup world in the Middle East is growing fast. New founders want money. Investors want new ideas. If you’re building a startup in UAE, Saudi Arabia, or Egypt, this guide is for you.

These three markets are hot. They have active VC firms, angel investors, government support, and fast-growing startup hubs. But each is different. In this guide, we will show:

- Where to raise funds

- What investors expect

- How to stand out

- Which sector is hot in each region

Let’s break it down by country.

🇦🇪 UAE: A Startup Funding Hub for MENA

Why UAE is a top place to raise startup capital

- Dubai and Abu Dhabi are startup magnets.

- Free zones like DIFC, ADGM make it easy to set up companies.

- There are many local and global VC firms.

- Hub71, NextGenFDI, and DIFC Innovation Hub support founders.

How to raise startup funding in UAE

Start with a pitch deck. Keep it clear and short. Highlight your traction and market size. UAE investors like startups with:

- Scalable models

- Strong teams

- Focus on MENA or global markets

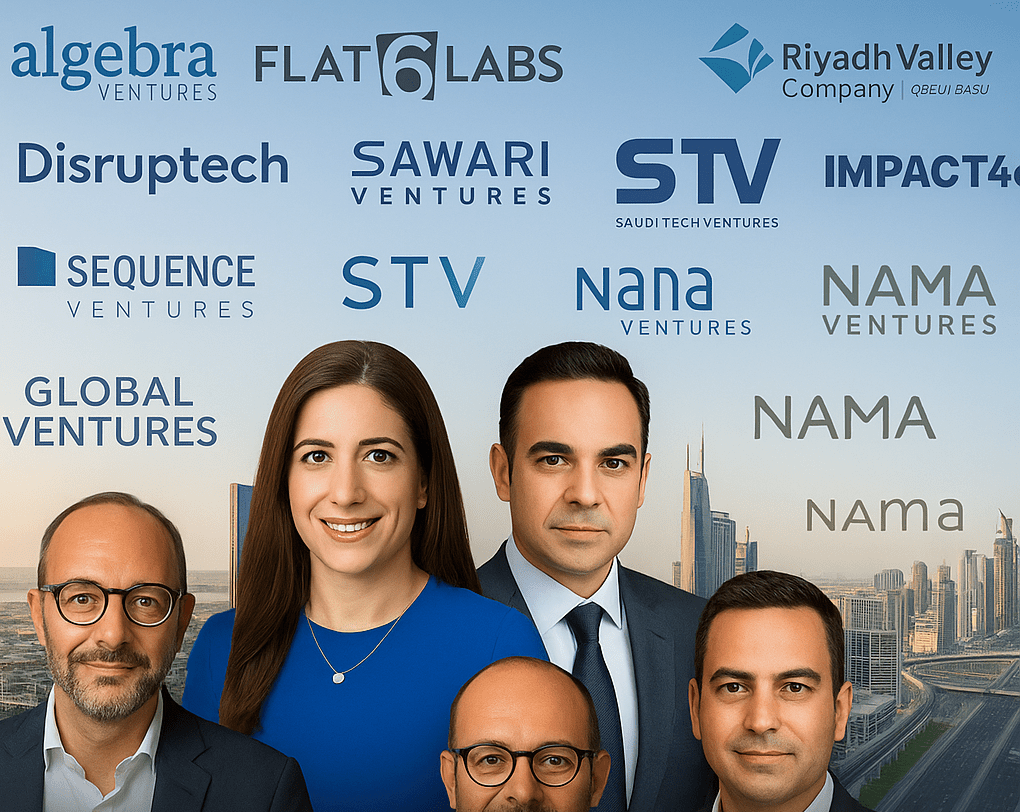

Popular UAE VC firms

- Global Ventures

- Shorooq Partners

- VentureSouq

- COTU Ventures

- Plus VC

Many UAE VCs invest at pre-seed to Series A. Some join later rounds.

Trending sectors for funding in UAE (2025)

- Fintech

- HealthTech

- ClimateTech

- B2B SaaS

- AI & Web3 tools

Tips for founders in UAE

- Join programs like Hub71 or Antler MENA

- Attend pitch events

- Reach out via warm intros

- Have a clear UAE or GCC go-to-market plan

🇸🇦 Saudi Arabia: The Region’s New Investment Giant

Why Saudi is booming

Saudi Arabia is investing big in tech and startups. Vision 2030 is changing everything. The Public Investment Fund (PIF), SVC, and Monsha’at are backing founders. In 2024 alone, startups in Saudi raised over $1.3B.

How to raise startup funding in Saudi

Build a product that solves local problems. Saudis want real impact. Start with local traction. Show value to users. Add Arabic localization if possible.

Government-backed VC funds work closely with private investors. You need a clear business model and early user growth.

Top Saudi VC firms

- Riyadh Valley Company

- STV (Saudi Tech Ventures)

- Impact46

- Raed Ventures

- Nama Ventures

Sectors attracting funds in Saudi (2025)

- Fintech

- E-commerce enablement

- Logistics & mobility

- PropTech

- Clean Energy & Sustainability

Tips for raising in Saudi

- Partner with local incubators (e.g., Misk, Flat6Labs Riyadh)

- Show alignment with Saudi Vision 2030

- Build strong governance and Sharia-compliant models

- Attend events like Leap and Bibaan

Saudi VC firms often do early checks ($100K–$2M), but PIF and others write larger cheques at Series A & B.

🇪🇬 Egypt: The Gateway to Africa and a Seed-Stage Powerhouse

Why Egypt is important

Egypt has a young population, a booming tech scene, and lower costs. Cairo has become a key place for early-stage investments in Africa and MENA. Investors love Egypt’s developer talent and market size.

How to raise startup funding in Egypt

Egyptian VCs are active at pre-seed and seed. You need a working product, some user traction, and a lean team. Many investors support startups with small rounds ($50K–$500K).

Accelerators play a big role. Flat6Labs Cairo, AUC V-Lab, and Falak Startups are top names.

Leading Egypt VC firms

- Algebra Ventures

- Flat6Labs

- Disruptech Ventures

- Sawari Ventures

- Sequence Ventures

Sectors attracting investors in Egypt (2025)

- Fintech & remittances

- Logistics

- EdTech

- AgriTech

- Mobility

Tips for founders in Egypt

- Keep burn low, stay lean

- Focus on product-market fit early

- Apply to accelerators first

- Show that your solution can scale to Africa or MENA

Many Egypt startups raise their first round locally and look to UAE or global investors for the next round.

🧾 Summary Table: UAE vs Saudi vs Egypt Funding Ecosystems

| Feature | UAE | Saudi Arabia | Egypt |

|---|---|---|---|

| Popular Funding Stage | Seed to Series A | Pre-seed to Series B | Pre-seed to Seed |

| Government Support | DIFC, ADGM, Hub71 | Vision 2030, PIF, SVC | Falak, ITIDA, Flat6Labs |

| Key Sectors | Fintech, AI, B2B SaaS | Mobility, E-commerce, Climate | Fintech, AgriTech, Logistics |

| Top VC Firms | Global Ventures, Shorooq | STV, Impact46, Raed | Algebra, Flat6Labs, Sawari |

| Fund Sizes | $100K – $10M+ | $250K – $20M | $50K – $1.5M |

| Language Preference | English | Arabic + English | Arabic + English |

| Events to Attend | Expand North Star, Step Conf | Leap, Bibaan | RiseUp Summit |

📌 Key Steps to Raise Startup Funding in the Middle East

- Pick your target market first

– Are your users in UAE, Saudi, or Egypt? Start there. - Build early traction

– Have real users and proof of value. - Create a clean pitch deck

– 10–12 slides max. Problem, solution, team, traction, ask. - Join local accelerators

– They connect you to early investors. - Target investors by geography and stage

– Match your round with the right VC or angel. - Be ready with data

– Investors want metrics, not just vision.

🔚 Final Thoughts

Raising startup funding in the Middle East is no longer hard. But it needs planning.

Each market has strengths:

- UAE is best for global VCs and scale-ready startups.

- Saudi Arabia is for local market-fit and national support.

- Egypt is where many founders start small and grow fast.

The capital is here. Investors are looking. You just need to show you’re ready.

💬 Bonus Resources

- List of 200+ Investors in UAE, Saudi, and Egypt

- How to Create a Pitch Deck That Wins Investors

- Download: Startup Funding Checklist (MENA version)

📥 Subscribe to FounderFirst.org to get:

- Weekly deal flow insights

- Top VCs and angels to follow

- Live startup pitch events in Dubai & Abu Dhabi

- Real founder stories & case studies from MENA

Leave a comment